The keyword “lien or levy” is commonly searched by people who are dealing with legal, tax, or financial problems. These two words often appear together in official letters, bank notices, tax warnings, and court documents.

Because they are used in similar situations, many people believe they mean the same thing. In reality, they do not.

Most people encounter these terms for the first time when something goes wrong unpaid taxes, overdue loans, or legal disputes. A letter may say that a lien has been placed on property or that a levy will be issued soon.

This can feel confusing and stressful, especially if you do not understand the difference. Is a lien serious? Is a levy worse? Can one lead to the other?

This article is written to solve that confusion clearly and simply. You will learn the exact meaning of lien and levy, how they differ, where the words come from, and how they are used in real life.

We will also look at British vs American usage, common mistakes, examples from everyday writing, and search trends. By the end of this guide, you will fully understand lien or levy and know which term to use in any situation.

Lien or Levy – Quick Answer

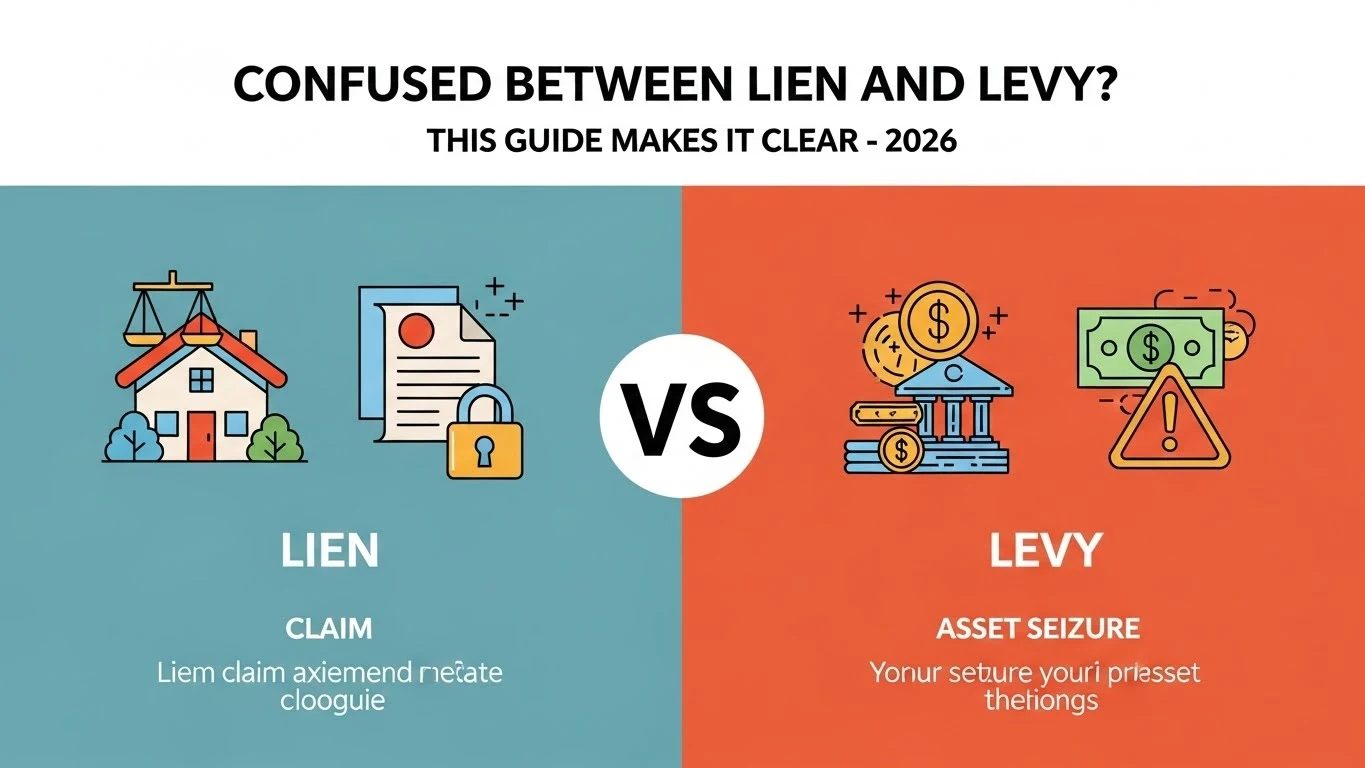

A lien is a legal claim on property. A levy is the act of taking property or money to pay a debt.

Simple Explanation

- A lien gives someone the right to claim property.

- A levy is the action of collecting or seizing assets.

Easy Examples

- The government places a lien on your house for unpaid taxes.

- The government levies your bank account and takes money.

👉 Think of it this way:

A lien is a lock, and a levy is opening the door and taking what’s inside.

More read about: Difference between logical and bitwise OR in Java

The Origin of Lien or Levy

Origin of Lien

The word lien comes from Old French lier, meaning “to bind” or “to tie.” It entered English legal language in the 18th century. The word reflects the idea of legally tying property to a debt.

A lien does not remove property from the owner. Instead, it creates a legal connection between the debt and the asset. This is why liens are often used as warnings or safeguards.

Origin of Levy

The word levy comes from the French word lever, meaning “to raise” or “to collect.” Historically, it was used for collecting taxes or raising armies. Over time, its meaning expanded to include the seizure of property or money.

Unlike a lien, a levy always involves action. It is about enforcement, not just rights.

Why the Difference Exists

The difference exists because:

- Lien = legal claim or right

- Levy = legal action or enforcement

British English vs American English Usage

There is no spelling difference between British and American English for lien or levy. However, the frequency and context of use differ.

Usage Comparison Table

| Term | American English | British English | Notes |

| Lien | Very common | Less common | Mostly used in US property and tax law |

| Levy | Common | Very common | Often used for taxes, charges, and fees |

In the UK, levy is widely used to describe government charges, such as a “carbon levy” or “education levy.” The word lien appears mostly in formal legal contexts.

Which Term Should You Use?

Use Lien when:

- Talking about property claims

- Referring to unpaid taxes or loans

- Writing US-based legal or financial content

Use Levy when:

- Describing seizure of money or property

- Talking about taxes or enforcement actions

- Writing for a UK or global audience

Audience-Based Advice

- US audience: Use both terms accurately and legally

- UK/Commonwealth audience: Explain lien if used

- Global audience: Define both terms clearly on first mention

Clear definitions help avoid legal and financial misunderstandings.

Common Mistakes with Lien or Levy

Mistake 1: Using Them as Synonyms

❌ “The bank placed a levy on my house.”

✔️ Correct: “The bank placed a lien on my house.”

Mistake 2: Treating a Lien as an Action

❌ “The government liened my account.”

✔ ️ Correct: “The government levied my account.”

Mistake 3: Ignoring Order

✔️ Usually, a lien comes first, then a levy.

Lien or Levy in Everyday Examples

Emails

“A tax lien has been filed due to unpaid balances.”

News Headlines

“Government announces new fuel levy starting next year.”

Social Media

“Did you know a tax lien can block the sale of your house?”

Legal Writing

“Failure to comply may result in a levy on assets.”

Lien or Levy / Google Trends & Usage Data

Search data shows that:

- Lien is searched heavily in the United States

- Levy has strong global search volume

- Searches spike during tax seasons and economic downturns

Context-Based Searches

- “Tax lien meaning” → US-focused

- “Government levy” → UK/global

- “Lien vs levy” → Legal confusion

This confirms that people search this keyword when facing real-world legal or financial issues.

Comparison Table: Lien vs Levy

| Feature | Lien | Levy |

| Type | Legal claim | Legal action |

| Involves seizure | No | Yes |

| Affects ownership | Indirect | Direct |

| Often first step | Yes | No |

| Common usage | Property & debt | Taxes & enforcement |

Frequently Asked Questions

1. Is a lien the same as a levy?

No. A lien is a claim. A levy is seizure.

2. Which is more serious, lien or levy?

A levy is more serious because assets are taken.

3. Can you remove a lien?

Yes, by paying the debt or settling the claim.

4. Does a levy mean immediate loss?

Often yes, especially for bank accounts.

5. Can a lien affect credit score?

Yes, especially tax liens.

6. Are liens only for taxes?

No. They apply to loans, services, and court judgments.

7. Can a levy be stopped?

Sometimes, if action is taken quickly.

Conclusion

The confusion around lien or levy is common, but once explained clearly, the difference is easy to understand. A lien is a legal claim placed on property to secure a debt. It does not take anything away, but it limits what the owner can do with that property.

A levy, on the other hand, is an enforcement action. It allows authorities to seize money or assets to settle unpaid obligations.

Knowing the difference matters. It helps you respond correctly to legal notices, communicate clearly in professional writing, and make informed financial decisions. In most cases, a lien serves as a warning, while a levy represents the final step.

Whether you are writing an article, reading a tax letter, or explaining legal terms to others, using lien and levy correctly builds clarity and trust.

Always define the term based on your audience and context. Clear language reduces confusion and protects you from costly mistakes.

I am an English author who loves words and their meaning. Writing is not just my work, it is my passion. I write to make English simple, clear, and easy to understand for everyone. My focus is on real language, real mistakes, and real learning. Every article I write comes from research, experience, and a love for honest writing. My goal is simple: help readers feel confident with English.